Showing 12 results for:

greenwood

Popular topics

All results

There has been an update on the dispute between The Gathering Spot and Greenwood.

Greenwood continues its mission toward economic empowerment for the Black and Latino community. The digital banking platform just acquired Valence to provide communities with support for professional development and job recruiting. The news comes on the heels of Greenwood’s acquisition of The Gathering Spot and solidifies the brand’s stance as a place where our people can not only learn skills for a better financial future but also get equipped with resources to survive and thrive. Valence was established in 2019 by Kobie Fuller, who is also the General Partner at Upfront Ventures. He, alongside Emily Slade and LaMer Walker, wanted to create a network specifically designed to help Black professionals connect with companies and vice versa. Now, Greenwood will leverage the company’s pipeline recruiting database to help companies diversify workforces of all levels from early career to the C-suite. This is a legendary move set to equip Greenwood’s community of roughly one million Black...

Since its launch, Greenwood has prioritized Black and Latinx individuals and business owners through its banking services. Now, the biggest and Black-owned digital banking platform is looking to further support the community with its latest acquisition. According to a press release, Greenwood has acquired The Gathering Spot — a private members-only club for Black professionals.

If you want to learn how to build a tech company, come to Greenwood! The Black-led and founded tech-enabled digital banking platform was built solely with Black people, Latinos, and true allies of the culture in mind. Now, the mission continues by offering the community the resources needed to build their own empire. In an all-new series, “The Making Of A Black Tech Company,” the platform is providing a firsthand look into how we all can play a role in bridging access and wealth gaps through financial solutions. Throughout the show, viewers will learn more about the company’s special approach to building a company rooted in tech. They will also hear directly from the company’s leaders and a few familiar celebrity faces who have invested not only funds but time and energy into Greenwood since its inception.

The National Black Bank Foundation (NBBF) is adding some heavy hitters to its board. According to Business Wire , NBBF is a racial justice nonprofit committed to ensuring the communities of color have access to capital in order to build wealth through the Black banking sector. Just last week the board appointed King Center CEO Dr. Bernice A. King and actor Hill Harper to its board of dynamic leaders. Harper and King will join a board of directors that includes ESPN analyst and Super Bowl XLIII winner Ryan Clark, National Bankers Association Chairman Robert James II, Aspen Institute Fellow Yolanda Daniel, and founder and CEO of Calliope Advisors Lauren McCann. “Black banks help Black families escape the continuum of poverty by building real wealth , which is why the work of uplifting these community anchors is so urgent,” said NBBF Board Chair and St. Louis Mayor Tishaura Jones. “We’re deeply honored that Dr. King and Hill have invested themselves in our mission.” Today there are...

MassMutual is linking up with Michigan’s only Black-owned bank to work toward closing the racial wealth gap! According to the news release , First Independence Bank (FIB) is the only Black-owned bank in Michigan and through the new strategic alliance with MassMutual Great Lakes (MMGL), they’ve committed to helping the underserved reshape how they view money. “At MassMutual Great Lakes, we believe every individual, small business owner, and corporation deserves the right to financial services and strategies designed to create stability,” said MassMutual Great Lakes Manuel Amezcua in an official news release. “Our commitment is to develop meaningful relationships that reshape the financial well-being and success of a diverse group of individuals and institutions in the communities we serve.” Since its launch in 1970, FIB has served the dreams and financial needs of Black Americans and is one of only 155 minority depository institutions, according to Black Enterprise, in the nation and...

Greenwood takes it up a notch! The digital banking platform made specifically with Black and Latino people and business owners in mind has announced that it has decided to partner with Mastercard as its network of choice for the bank’s first debit card. According to PR Newswire, the matte black debit Mastercard will give its cardholders a digital-centric experience along with an extensive list of security and concierge benefits. The card will also include innovative giveback programs with a focus on supporting both Black and Latino causes and businesses. Together the companies will deliver an Enhanced Mastercard® debit program which will provide all members financial protections and management services that include credit monitoring and transaction alerts as well as ID Theft Protection™, emergency card replacement, Mastercard Airport Concierge™, and access to once-in-a-lifetime exclusive Priceless offers and experiences. “As Greenwood works toward bringing practical products to...

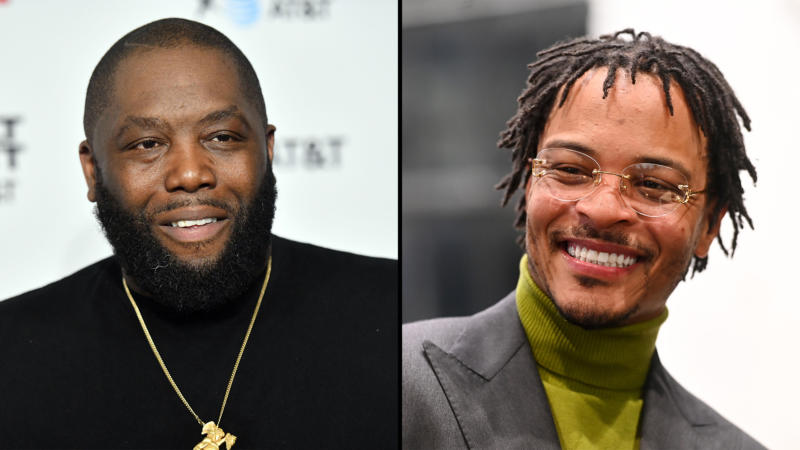

Actor and community activist Jesse Williams has become the latest investor to join Greenwood’s financial empowerment efforts. Greenwood — the new digital banking platform for Black and Latinx entrepreneurs and small businesses — recently launched to help repair the hole in Atlanta’s finance market with the help of rapper Killer Mike, former Atlanta Mayor Andrew Young, and Bounce TV founder Ryan Glover. Williams has now signed on to help the digital bank carry out its mission to strengthen the economy for communities of color. “I’m excited to join the Greenwood team and work to advance economic prosperity for people of color,” he said in a statement . “The time has come for Black and Latinx communities in America to strengthen our economic condition and influence. By increasing access to essential banking services and financial education, Greenwood is a key part of that movement.” View this post on Instagram A post shared by Greenwood (@bankgreenwood) Williams is most known for...

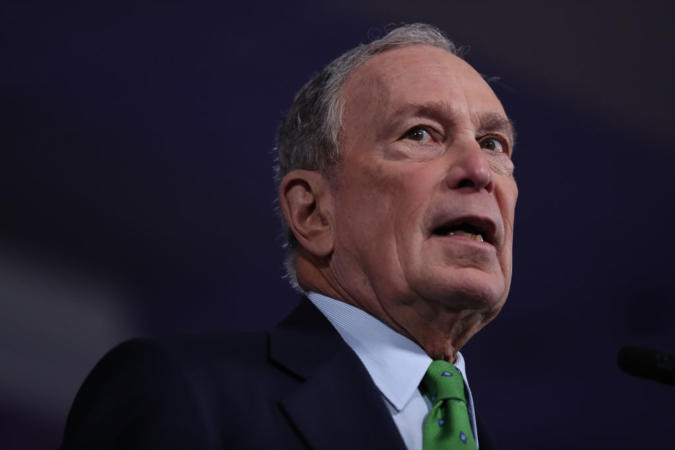

Democratic candidates are gearing up to secure the Black vote in the upcoming 2020 presidential election. Former mayor of New York City and presidential hopeful, Mike Bloomberg is among those rolling out initiatives and reform plans aimed at empowering and supporting Black businesses and entrepreneurship. According to Black Enterprise Bloomberg announced his Greenwood Initiative: Economic Justice For Black America plan during MLK weekend. The plan is named after the Greenwood community located in Tulsa, Oklahoma which was the home of Black WallStreet, a thriving early 20th-century community of Black businesses and entrepreneurs. According to Bloomberg’s official campaign site , the Greenwood plan promises to create 100,000 new Black-owned businesses and one million new Black homeowners over the next decade. The details of the Greenwood plan are to increase Black businesses by providing one-stop shops for entrepreneurs, increasing incubators, strengthening Black-owned banks, and...