Showing 5 results for:

caden-harris

Popular topics

All results

A ban on TikTok may be imminent in the United States. As AFROTECH™ previously reported, a 12-page bill was proposed by the House of Representatives to eliminate its use and access in the United States if its China-based parent company ByteDance doesn’t sell the platform. This would cause great disruption to many as more than 150 million individuals in the United States are TikTok users, according to the social platform’s website. The bill, which was introduced as the Protecting Americans from Foreign Adversary Controlled Applications Act , serves to “protect the national security of the United States from the threat posed by foreign adversary controlled applications,” per CBS News. If the bill is green lit by the Senate and President Joe Biden and signed into law, ByteDance will be required to sell the platform within 180 days — or it will be banned from distributing the app and any others through its subsidiaries or firms “controlled by a foreign adversary.” On March 13, 2024, the...

Notable names in sports and music have gathered to make credit building more accessible to the masses. According to a press release shared with AFROTECH™, Tinashe, Quavo, Chris Paul, and Marshawn Lynch are among the investors who participated in Altro’s latest strategic funding round totaling $4 million. The round brings the credit-building and financial literacy platform’s total funding to $22 million. Altro, formerly known as Perch, was founded in 2019 by Michael Broughton. It allows users to strengthen their credit scores through “everyday payment and subscriptions” such as Netflix, Spotify, Amazon Prime, Starz, and more. Additionally, the company offers educational resources even to its baseline free membership model. Resources include Altro’s Convo, consisting of brief audio episodes discussing various cultural and financial subjects, and in-person and virtual networking events and opportunities. Prior, Altro was available in 10 U.S. states. In light of the star-studded round,...

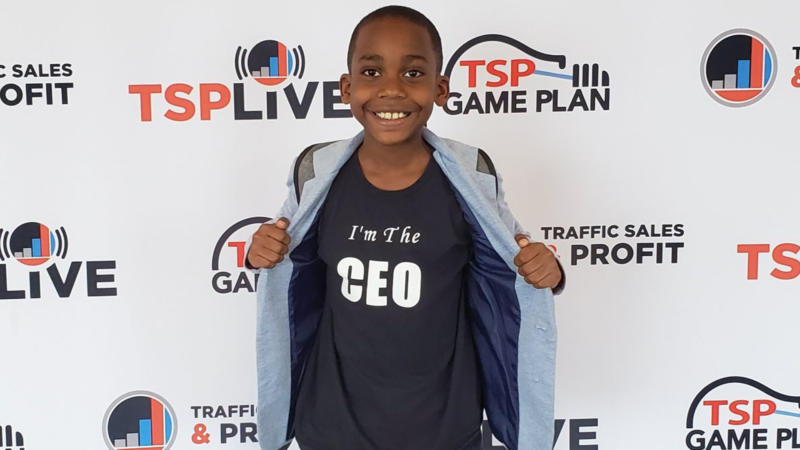

You’re never too young to develop financial literacy skills! According to Black Business, 11-year-old Caden Harris has taken in tons of knowledge when it comes to the financial sector, and now he is working to help others do the same. At the tender age of seven, thanks to the support of his parents, Caden launched his very first business. By age eight, he had written his first book and now, in the double-digits, he’s purchased a 54-seat passenger bus. His goal is to raise funds in order to transform the bus into a traveling mobile unit to teach financial literacy to students at local schools. This is not anything new for Caden, who continuously gets tapped by local schools, youth church groups, and Boys & Girls Clubs, and has also already created products to teach children financial literacy. As he expands his efforts even more with the bus, Caden’s mobile financial learning bus will include more ways of shaping the minds of the youth when it comes to learning how to earn, save and...