Showing 61 results for:

accountant

Popular topics

All results

Ira Salls is an inspiration for her history-making role as a McDonald’s franchisee. Salls, a Cincinnati, OH, native, graduated from Northern Illinois University and later earned both an MBA and a master’s degree in public administration from Northwestern University. She secured her franchise title in 1991, as she explained during an interview with WHAS 11 in 2021. Before becoming an owner and operator, she first worked at the fast-food chain as an accountant. “I was hired by McDonald’s because I already had a degree and (was) a CPA. McDonald’s was forward thinking, and they wanted Black CPAs working in their accounting department,” she recalled to the outlet. Salls’ pivot to owning her own McDonald’s locations led her to become the first Black woman franchisee of the chain in Kentucky and Indiana in 1991, the Louisville Business Journal reports. She would go on to become one of the company’s most successful operators, managing six locations in Louisville, KY. She also understood the...

GloRilla had to take control of her spending after her first hit single took off. In 2022, the Memphis, TN-born artist, born Gloria Hallelujah Woods, found success with the release of her single “F.N.F. (Let’s Go),” produced by Hitkidd. ”It didn’t take the song long to blow up. It blew up in like three days,” she said during an interview on “The Shop” podcast. “So, I was just traveling the world like two days after I dropped that song ‘cause all the labels were calling me everywhere. So yeah, my life changed, changed right after I dropped that song.” Her newfound fame came with some learning curves, such as keeping her spending habits in check. During the interview, she notes that she shifted her mindset with spending when rap-artist-turned-music-executive Yo Gotti intervened and suggested she hire an accountant. “My first year I blew up, this was before I got an accountant. I was just spending money, and I’m like, ‘Okay, I’m getting it. I’m making it but I’m spending it too,'” she...

An accountant took advantage of Kenan Thompson’s glory days at Nickelodeon. During an interview on “The Breakfast Club” podcast, the comedian recalls his experience with an accountant who went sour between 1999 and 2000, leading him to go broke and lose $1.5 million. “I’ve been blessed to continue working, but I had a bad accountant, and it came to the light around ’99, around 2000, which was really bad timing ’cause that’s right when I left my consistent gig. So, then I went into being an adult actor for hire, and that is very hit and miss,” Thompson said. He was introduced to the accountant by his mother, as the man had previously helped her with her taxes. The pair had given the accountant power of attorney, which would permit him to act on their behalf on a temporary or permanent basis, according to the American Bar. “We gave that dude power of attorney when we shouldn’t have. I was a kid and my mom was trying to protect me,” Thompson mentioned. “He had helped her out of her and...

Following a hiatus from 2006 to 2017, Xscape has been back at it in the industry ever since. Now, as a trio, Kandi Burruss, Tameka “Tiny” Harris, and Tamika Scott have continued to tour on the road. What’s more, they’ve released their Bravo show alongside fellow legendary R&B group, SWV, “SWV & Xscape: The Queens of R&B.”

“I’ma spend his cream, seduce, and scheme.” If you’re not familiar with those lyrics, get hip as they are the catchy words to the single from the fictional characters “Shawna” and “Mia” from Issa Rae’s “RAP SH!T.” And it looks as if New York rapper Fat Joe is on the opposite side of those lyrics in real life. According to a report from Billboard, the “Lean Back” rapper is suing his accountants after claiming they stole millions of dollars in a “fraudulent scheme.”

LL COOL J is setting the record straight for anyone with something to say about the pioneers of Hip-Hop. The genre, which was birthed by DJ Kool Herc during a back-to-school party hosted in the Bronx, NY, on Aug. 11, 1973, has changed the lives of people across, not just the nation, but the planet. Now, some recent remarks made by DJ Akademiks have caused some to raise their eyebrows and give a reminder of what those early contributions to Hip-Hop looked like.

Picture it, the year is 2007, and from speakers all across the nation, you could hear the melodic echo of, “You can stand under my umbrella, ella, ella, eh, eh, eh.” From dirty whining to fans singing at the top of their lungs, Rihanna had music listeners in a proverbial chokehold with her chart-topping hit. This phenomenon would prove consistent as the Barbadian artist continued to make Billboard hits for almost every occasion. Want to set the straight record straight about who you really are? Consider playing “Needed Me.” In a particular mood to be in the streets? “Rude Boy” may be your song of choice. And if you need to get what you’re owed, there’s little doubt that “B-tch Better Have My Money” is your anthem. No matter where you land, there is not a lot of space to deny Rihanna’s impact on music. However, the 34-year-old artist didn’t limit herself to music. Born Robyn Fenty, the musician got deep into her cosmetic and lingerie bag with her brands Fenty Beauty and Savage x...

When you started your business , you may have been looking for ways to save as much as possible. Perhaps you’ve considered hiring an accountant but can’t seem to justify the extra expense. However, you could actually be saving your business money in the long run. Below are 4 reasons why you should hire an accountant for your small business. 1. SAVE MONEY Accountants are experts in taxes. That means when tax time rolls around, you’ll be able to save money through tax breaks and deductions. In fact, in a survey of about 400 small business owners, over half of them believed they overpay in taxes each year. That same survey showed that accountants are the most important professionals for small businesses — ahead of attorneys. 2. REAP BENEFITS FROM GOOD BOOKKEEPING There are likely lots of other things you’d rather do than perform the mundane tasks of collecting records, reconciling accounts, and everything else involved in bookkeeping. Hiring an accountant can save you from this work...

GloRilla once admitted that she plans to become a billionaire and continues to progress towards this milestone. The Memphis-born rapper has remained the talk of the town, lighting up the charts through hit singles that include “TGIF” and “WHATCHU KNO ABOUT ME” and what started it all, “F.N.F.” released in 2022. “It mean a lot to be able to be a a voice for my city,” she said during an interview with AFROTECH™. Before the artist’s journey kicked into gear, she worked overtime to make her dreams a reality. Working at jobs such as Nike and FedEx with little to no energy, she remained optimistic the grind would pay off, and it has. “I was doing 12 hours at Nike and maybe seven to eight hours at FedEx. And I was just doing all that to sponsor my rapid career so I could be able to pay for videos and studio time,” she explained. In 2022, GloRilla signed to Yo Gotti’s label Collective Music Group. He has remained a constant supporter in her journey as an artist and in business. As AFROTECH™...

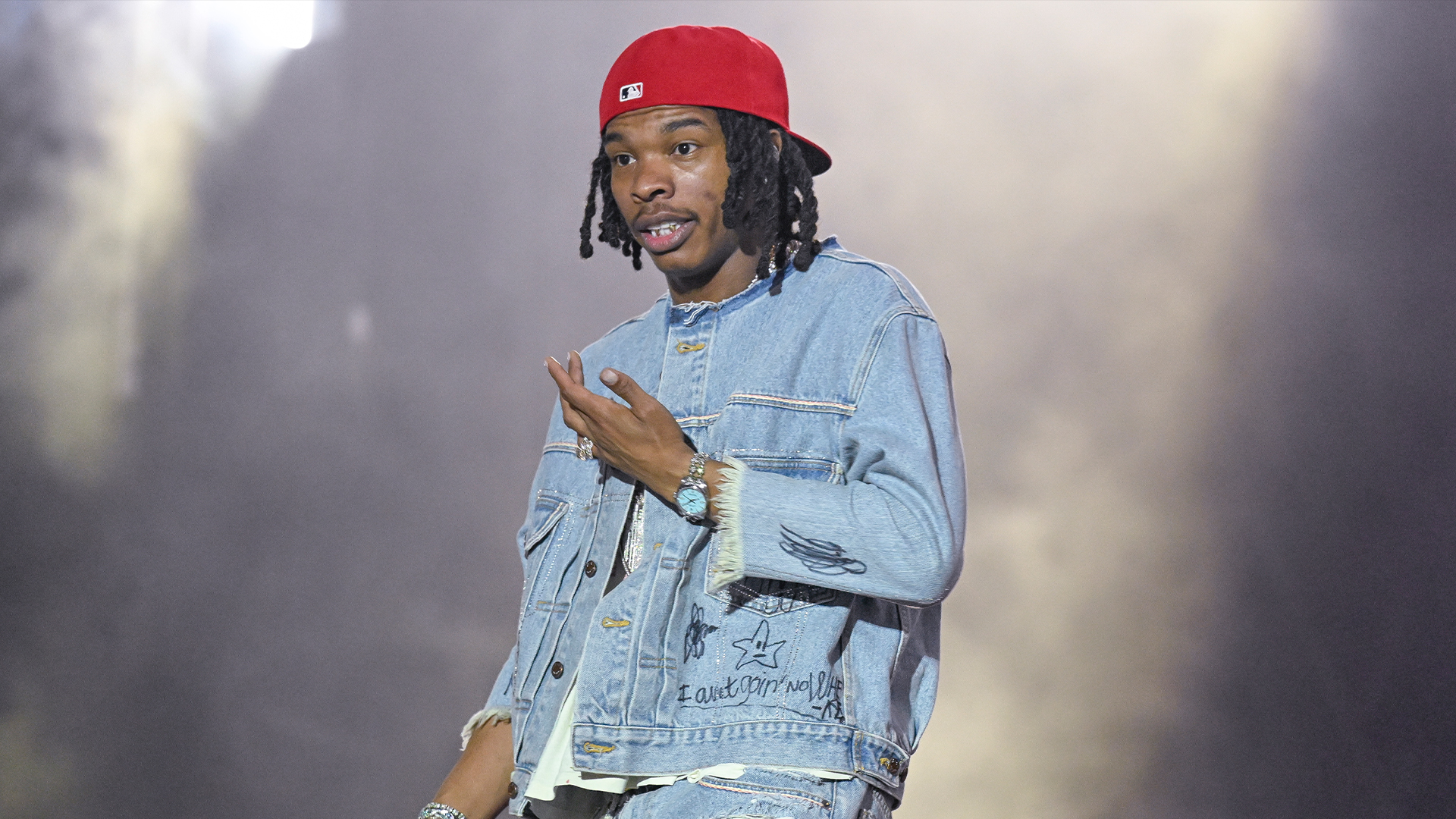

Despite earning millions, Lil Baby did not pay taxes for his first two years in the music industry. The Atlanta, GA-born rapper, known for chart-topping hits like “Drip Too Hard” and “We Paid,” appeared on the “A Safe Place Podcast,” hosted by Yachty, and discussed the financial learning curve. While he acknowledged having some understanding of investing and saving, he was unaware of the importance of taxes when he first entered the industry. His debut album, released in 2018 under Quality Control Music, marked the beginning of his rise to stardom. “I done got over $100 million from labels and deals. Not one time nobody still haven’t told me how to pay my taxes. Nobody even never told me pay my taxes,” Lil Baby explained on the podcast. “I always knew from growing up, like from being around, I heard people have tax problems, people don’t pay their taxes. I was doing it so wrong, my first tax bills was so high ’cause I was on some hustling sh-t like saving all my money. The more...

John Hope Bryant is investing in the businesses of Albany State University graduates. As AFROTECH™ previously reported, Bryant has served as the chairman and CEO of Operation HOPE Inc. since 1992. The organization focuses on improving financial well-being in underserved communities, benefiting 2.8 million people and directing $2.4 billion in private capital. During an appearance on the “Black Tech Green Money” podcast, Bryant emphasized that financial literacy is the new civil rights movement for this generation. “We have got to be as obsessed with this as we were with the right to vote,” he explained. Bryant continues to be a voice and a vessel, and this was displayed on Saturday, Dec. 14, 2024, at Albany State University (ASU) in New York. He served as the commencement speaker in front of a crowd of over 700 students, according to WALB News. “John and I are good friends. We’ve known each other for a while,” ASU I nterim President Dr. Lawrence M. Drake II told the outlet. “I also...

Financial literacy is the new civil rights movement according to John Hope Bryant. Bryant, a passionate advocate for economic empowerment, urges the Black community to adopt a laser-focused mindset on f inancial literacy. Since 1992, he has served as Chairman and CEO of Operation HOPE, Inc., dedicating himself to empowering underserved communities. According to its LinkedIn profile, the organization has impacted over 2.8 million people and has facilitated the direction of $2.4 billion in private capital. The Oprah Rule Bryant appeared on the “Black Tech Green Money” (BTGM) podcast, emphasizing the importance of understanding relationship capital, forming strategic partnerships, adopting a broader vision of wealth-building, and the day he learned the “Oprah rule.” He had been investigated before receiving the Use Your Life Award from Oprah Winfrey, an honor given to individuals improving others’ lives through charity. “When her investigators came around after she said she wanted to...

According to BizBuySell’s Confidence Index , a tool created to examine how roughly 3,000 members of the business-owner and -buyer community feel about the current sales market, confidence is up for both groups for the first time since they began measuring in 2013. Seller confidence is up four points, and buyer confidence is up two, from 46 to 50 and 52 to 54 respectively. With those sentiments on the rise, some might feel that it’s the right time to sell their business, hopefully turning a profit. Therein arrives the big question: how do you price a business for sale? Pricing a business for sale is one of the most critical steps in the selling process. Whether you’re a business owner looking to retire or an entrepreneur wanting to cash out, determining the right price is essential for attracting potential buyers while ensuring that you get a fair value for all your hard work. It’s important to approach the task with careful analysis and a clear understanding of both the market and...

Cliff Vmir continues to build on his success as a seasoned hair stylist. Turning His Passion For Hair Into A Brand Vmir began showing interest in hair care at 8 years old. However, at 14, when his parents separated, he fully committed to his passion. This allowed him to financially support his mother, who had been out of work for three months due to a knee replacement. “It wasn’t until my mom and my dad split up completely, when I was 14, that I was able to kind of go in full-throttle and understand that this isn’t something that I wanna just play around with. This is something that I can make money from,” Vmir told AFROTECH™ in an interview. “It’s crazy ’cause it’s something that I love to do… I also feel like with my mom and my dad splitting up, it was just kind of something that financially I wanted to help my mom. So not saying that I was forced into it, but I felt like it was only right for me to just use what I have to get what we need, and I was able to kind of help support...